About Missional Money Financial Planning Course

Missional Money Financial Planning is an online self-study self-paced course designed to help investors create a compelling financial plan in 30 days.

-

Save More Money

-

Pay Lower Taxes

-

Build a Better Retirement

Principles and Process

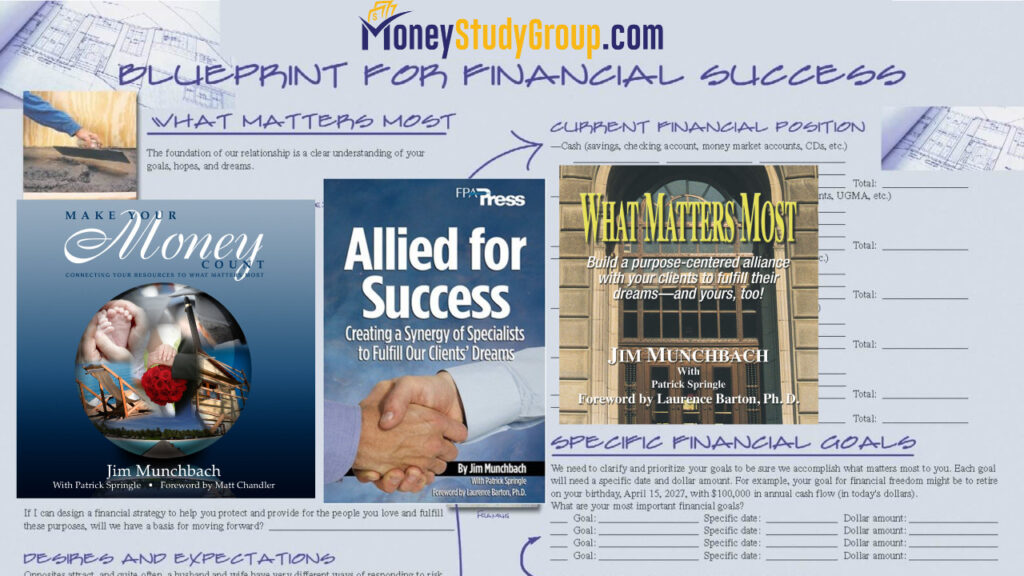

Missional Money Financial Planning is based on the principles and process outlined in Jim Munchbach’s books: Make Your Money Count, What Matters Most, and Allied for Success. The online course features The Blueprint for Financial Success™.

The Principles and The Process: Our courses (Money Study Group and Missional Money Financial Planning) feature The Blueprint for Financial Success™.

Sponsored by BayRock

The Missional Money Financial Planning course is sponsored by BayRock Financial, a Texas-Based RIA. Money Study Group is also sponsored by BayRock. In order to provide high quality online training, the initial cost of production far exceeds what we charge for the services included in our programs. Rather than charging commensurate prices, crowd-funding, or raising startup capital for the educational resources provided by Munchbach Family Office, we chose to create a sponsorship arrangement with BayRock.

Conflict of Interest

A conflict of interest occurs when an entity or individual becomes unreliable because of a clash between personal (or self-serving) interests and professional duties or responsibilities. Such a conflict occurs when a company or person has a vested interest—such as money, status, knowledge, relationships, or reputation—which puts into question whether their actions, judgment, and/or decision-making can be unbiased. When such a situation arises, the party is usually asked to remove themselves, and it is often legally required of them.

BayRock makes decisions in a fiduciary context for clients who have signed agreements in place. BayRock is regulated by The Texas Securities Board which provides oversight that helps to identify any contending interests that need to be clearly identified. BayRock’s process for identifying and communicating conflicts of interest for advisory and/or financial planning clients is an ongoing part of the compliance reivew process.

Our Educational services (Online courses including Missional Money Financial Planning and Money Study Group) are sponsored by BayRock in order to keep the cost as low as possible for students and investors who want to have access to BayRock’s premium planning platform without having to pay the advisory fees or the financial planning fees that are a part of the fiduciary agreement with BayRock.

Jim Munchbach serves as CEO of BayRock and also receives compensation from the Bauer College of Business at University of Houston for teaching Personal Finance (Money Study Group). Additionally, students are charged a small fee to gain access to the online course content as well as the financial planning software which is also available for BayRock clients at a much higher price.

While Jim Munchbach may be considered to have a conflict of interest, the University of Houston policy regarding compensation for text books and other course material is quite clear. To the extent that a conflict of interest may or may not exist in the conduct of teaching at the Bauer College of Business at University of Houston while also providing fiduciary services to clients of BayRock Financial, Jim has taken the following steps to be as transparent as possible:

-

BayRock Legal Documents outline Jim’s role as Adjunct Professor at UH

-

BayRock helps to subsidize the production cost of course materials so that students pay far below actual cost for the materials used in Jim’s Personal Finance Course.

-

Jim Munchbach has personally contributed to the overall cost of the course so that students actually pay about 20% less than they paid for the course material that was used pre-covid (Dave Ramsey’s College Foundations material had cost of $98.00 – $125.00 per student).

-

The total cost for Money Study Group is far below the prevailing cost of materials used in Personal Finance courses at other universities.

-

The overall value of the technology used to create a better educational experiment for students at the Bauer College of Business at University of Houston, far exceeds the current cost of Money Study Group.

Best of Class Technology

Thinkific

Thinkific allows us to create courses that delight. We wanted create a self-paced online course with live classes that integrate the financial planning principles and process outlined in Make Your Money Count, What Matters Most, and Allied for Success. Each of these books are written by Jim Munchbach, CFP®, CPCU®, CLU®, ChFC®. Thinkific makes it easy to translate the CFP® Professional expertise into learning experiences that produce better results.

BayRock and RightCapital

Interactive Financial Planning

Your interactive experience includes several elements that will clearly illustrate multiple scenarios, stress tests, and much much more, allowing you to learn not just principles of personal finance – but a process you can put to work to build your financial future.

Tax-Efficient Strategies

Easily see how you can save money with an optimal tax-efficient distribution strategy—learn about withdrawal schedules and Roth conversions in a way you’ll truly understand.

Social Security Optimization

Learn how to maximize your Social Security income. You’ll learn how to confidently make big decisions, like when to start receiving benefits.

Budgeting Tools

Powerful tools to manage your budget, track spending in various categories, and better manage your expectations for future spending.

Student Loan Management

Our unique student loan module will illustrate different scenarios so you can reduce your payments. Learn how to ease the burden of student debt for yourself and – someday – your children.

Insurance Needs Evaluation

Learn how to protect your assets in the event of situations such as disability or death. Evaluate your insurance needs in different situations and identify ways to ensure that you’re making wise decisions with your insurance budget. Because you’ll spend a lot of money on insurance in your lifetime!

Basic Estate Planning

Learn the basice flow of assets at the end of life, including any possible estate tax ramifications. Replace your anxiety with the peace of mind, knowing your assets are in order.

Account Aggregation

Bring together your bank accounts, credit cards, and externally-held investment accounts all in one place. It’s finally easy to see your full financial picture.

Streamlined Planning Process

Digital onboarding is easy. Using the same premium planning portal BayRock uses for our best wealth management clients, these six simple steps will streamline your planning experience. Get started into your new student/client portal now!

It’s easy for you and your loved ones to get up and running. We’ll help you create a compelling financial plan for your future!

-

Save More Money

-

Pay Lower Taxes

-

Build a Better Retirement

Financial Planning Mobile App

-

You can have access to your financial plan at any time!

-

Check your information on the go on any device.

-

RightCapital mobile app for account balances, budget, and more.