Investment Planning Strategies with Bayrock Financial

At Bayrock Financial, we understand the importance of comprehensive investment planning strategies to help you achieve your financial goals. As an independent fiduciary advisor, we pride ourselves on conducting a thoughtful Gap Analysis while working with your advisory team. We believe that advisor coordination is key to a well-coordinated financial plan.

The Benefits of Working with an Independent Fiduciary Advisor

When you choose to work with an independent fiduciary advisor, you can expect the following benefits:

1. Thoughtful Gap Analysis

Our team at Bayrock Financial conducts a thorough Gap Analysis to assess your current financial situation and identify any gaps or areas that need improvement. This analysis helps us understand your unique needs and tailor our investment planning strategies to align with your goals.

2. Advisor Coordination

We recognize the importance of collaboration among your financial professionals. Unlike many other advisors, we ensure that your CPA, family attorney, insurance agent, and investment advisor are all on the same page. Our commitment to advisor coordination ensures that everyone involved in your financial matters is working together towards your best interests.

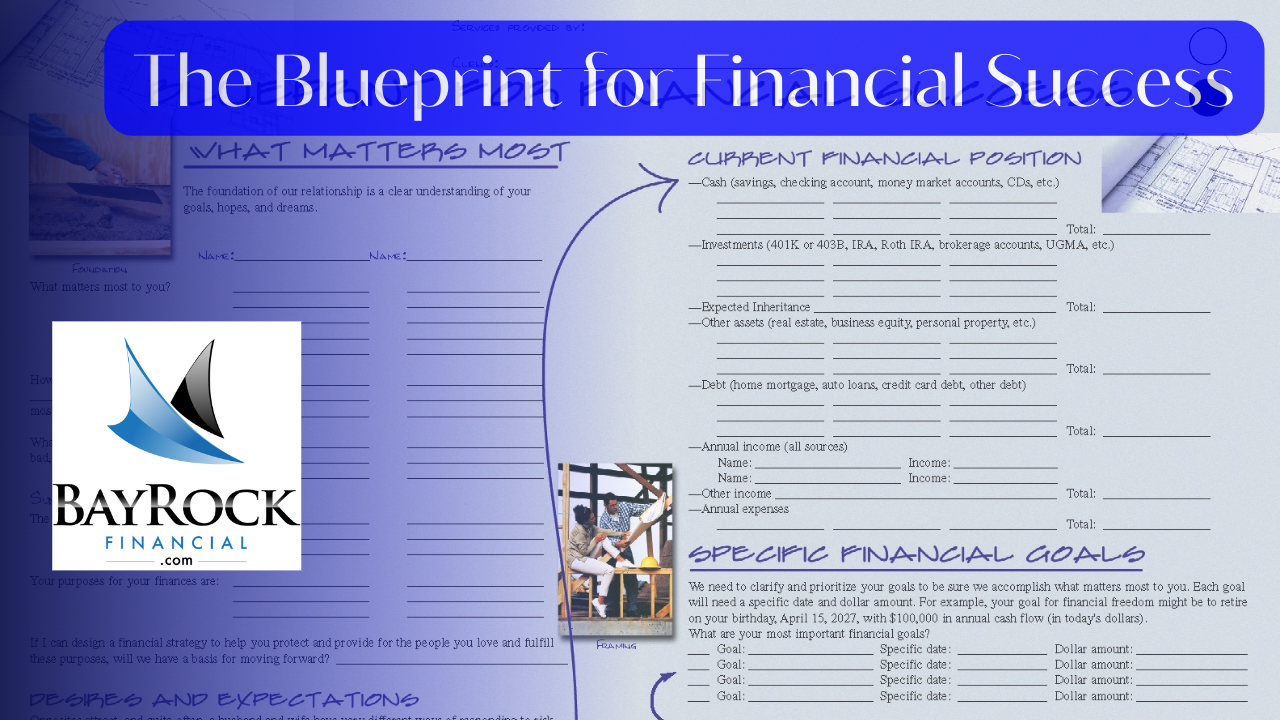

3. Holistic Financial Blueprint

By working with an independent fiduciary advisor like Bayrock Financial, you gain access to a holistic financial blueprint that connects all the dots in the right scope and sequence. We believe in taking a comprehensive approach to investment planning, addressing various aspects of your financial life to ensure a well-rounded strategy. The Blueprint for Financial Success:

Our Investment Planning Strategies

As part of our holistic approach, we provide a range of investment planning strategies that encompass the following areas:

-

Retirement Planning: We help you plan for a financially secure retirement by analyzing your current savings, estimating future needs, and implementing appropriate investment strategies.

-

Risk Management and Insurance Planning: We assess your insurance coverage to ensure adequate protection against unforeseen events, such as disability, illness, or death.

-

Estate Planning: Our advisors work with you to develop an estate plan that preserves your assets and ensures a smooth transfer of wealth to your beneficiaries.

-

Education Planning: We assist you in planning for the education expenses of your children or grandchildren, helping you navigate various saving options and investment vehicles.

-

Tax Planning Strategies: Our team explores tax-efficient strategies to minimize your tax liability, maximizing your investment returns and overall financial well-being.

-

Investment Management Strategies: We develop personalized investment strategies tailored to your risk tolerance, time horizon, and financial goals.

-

Cash Flow Management: We help you optimize your cash flow, ensuring that your income and expenses are effectively managed to support your long-term financial objectives.

By integrating these investment planning strategies into a cohesive financial plan, we strive to provide you with a roadmap for success.

Contact us Anytime #AskMeAnything. At Bayrock Financial we’re here when you’re ready to start your retirement planning journey and take a step closer to financial independence.