Client Intake Form

Client intake forms are used by a variety of organizations in several industries and practices. Doctors, law firms, wealth advisors, and virtually any other kind of company or business that deals with clients will use some form of client intake forms:

-

Medical Doctor’s Offices

-

Law Firms

-

Accounting Firms

-

Wealth Advisory Firms

-

Advertising Agencies

-

Tax Preparers

-

Real Estate Agencies

-

Event Planners

-

Construction Companies

-

Photographers and Videographers

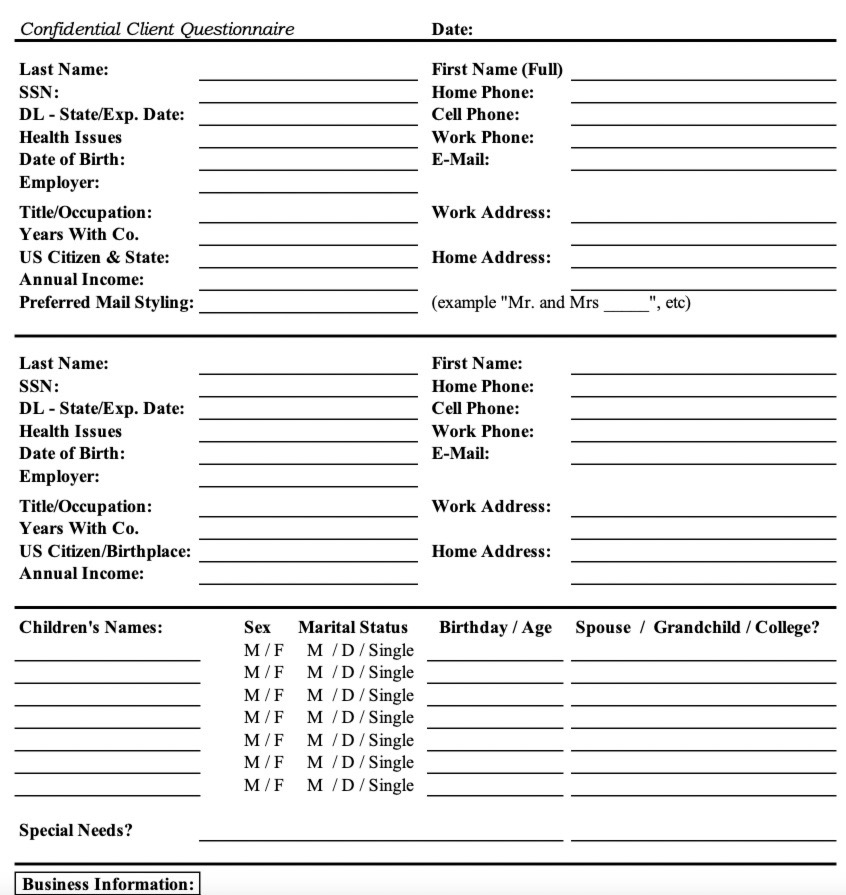

BayRock’s client intake form is a questionnaire we use to onboard new clients. It asks you to provide information that can help us determine whether you are a good fit for our services and it helps to shape our financial planning strategies to better address your financial planning and investment management needs, interests, and pain points.

Financial Plan Organizer

Our Client Intake form can also serve as a helpful organizer for your family or business. While many of the items listed on our client intake form may not be relevant to your specific situation, we have found that many of the items listed on our client intake form will prompt our clients to consider taking action in some areas of financial planning that may not have been on your radar screen.

Client Intake Form Download Links:

Client Intake Form Download (PDF version)

Client Intake Form Download (Excel version)

Personal Information

If you’re considering working with BayRock, we will need the first section of your Client Intake Form completed in order to set up your client file. The first section of the Client Intake Form contains all of the personal information that will be needed in the first phase of the onboarding process.