Tax and Penalty-Free Distribution From Roth IRA

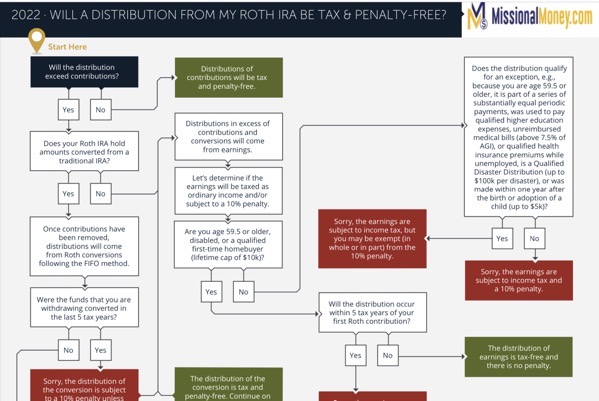

Will A Distribution From My Roth IRA Be Tax and Penalty-Free? Some of you may have unique circumstances that could result in a distribution from a Roth IRA being taxed or penalized. Many of these situations rarely come up, which makes it hard to remember the usual distribution rules from a Roth IRA.

To help make this easier, we have created the “Will A Distribution From My Roth IRA Be Tax and Penalty-Free” flowchart. This flowchart helps to quickly identify circumstances that could have an impact on how a distribution is taxed (and penalized). It considers the following:

-

The 5 Year Rule

-

Impact of Roth conversions

-

Distribution ordering rules

-

Conditions that trigger the 10% early distribution penalty

-

Exceptions to the 10% early distribution penalty

Download:

Tax and Penalty-Free Distribution From Roth IRA Overview

Tax and Penalty-Free Distribution From Roth IRA – START HERE

Tax and Penalty-Free Distribution From Roth IRA

Tax and Penalty-Free Distribution From Roth IRA

Tax and Penalty-Free Distribution From Roth IRA

More information about Tax and Penalty-Free Distribution From Roth IRA from Charles Schwab’s Website

Roth IRA Withdrawal Rules

Open a Roth IRA and take advantage of after-tax benefits as you save for retirement.

With a Roth IRA, contributions are not tax-deductible, but earnings can grow tax-free, and qualified withdrawals are tax- and penalty-free. Roth IRA withdrawal and penalty rules vary depending on your age and how long you’ve had the account and other factors. Before making a Roth IRA withdrawal, keep in mind the following guidelines, to avoid a potential 10% early withdrawal penalty:

Withdrawals must be taken after age 59½.

Withdrawals must be taken after a five-year holding period.

There are exceptions to the early withdrawal penalty, such as a first-time home purchase, college expenses, and birth or adoption expenses.

- Age 59 and under

You can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. However, you may have to pay taxes and penalties on earnings in your Roth IRA.

- Withdrawals from a Roth IRA you’ve had less than five years.

If you take a distribution of Roth IRA earnings before you reach age 59½ and before the account is five years old, the earnings may be subject to taxes and penalties. You may be able to avoid penalties (but not taxes) in the following situations:

- You use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase.

- You use the withdrawal to pay for qualified education expenses.

- You use the withdrawal for qualified expenses related to a birth or adoption.

- You become disabled or pass away.

- You use the withdrawal to pay for unreimbursed medical expenses or health insurance if you’re unemployed.

- The distribution is made in substantially equal periodic payments.

Withdrawals from a Roth IRA you’ve had more than five years.

If you’re under age 59½ and your Roth IRA has been open five years or more,1 your earnings will not be subject to taxes if you meet one of the following conditions:

- You use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase.

- You become disabled or pass away.

Over age 59½

Withdrawals from a Roth IRA you’ve had less than five years. If you haven’t met the five-year holding requirement, your earnings will be subject to taxes but not penalties.

Withdrawals from a Roth IRA you’ve had more than five years.

If you’ve met the five-year holding requirement, you can withdraw money from a Roth IRA with no taxes or penalties.

Remember that unlike a Traditional IRA, with a Roth IRA there are no Required Minimum Distributions.

For all ages

If you transfer your Traditional or Roth IRA and request that the check be made payable to you, you have up to 60 days to deposit that check into another IRA without taxes or penalties. This is known as a “nontaxable rollover,” and you can do this once within a 12-month period.