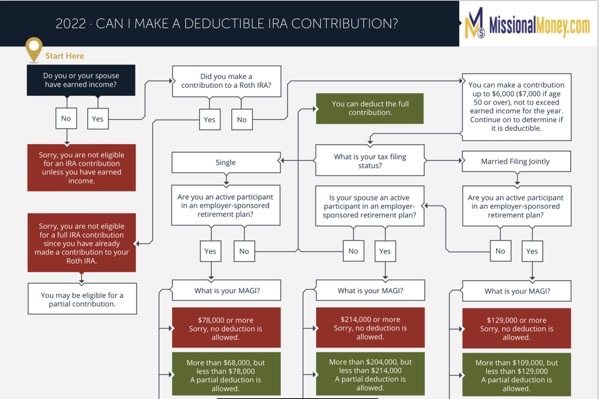

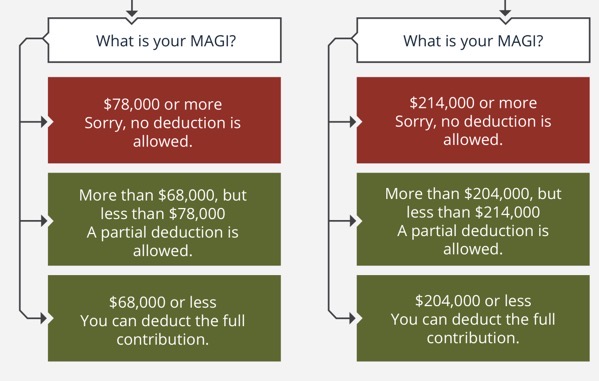

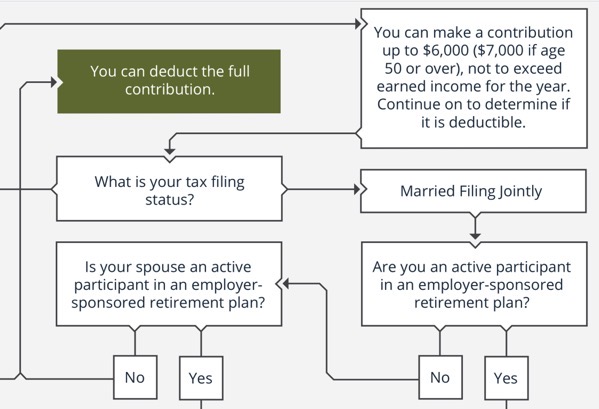

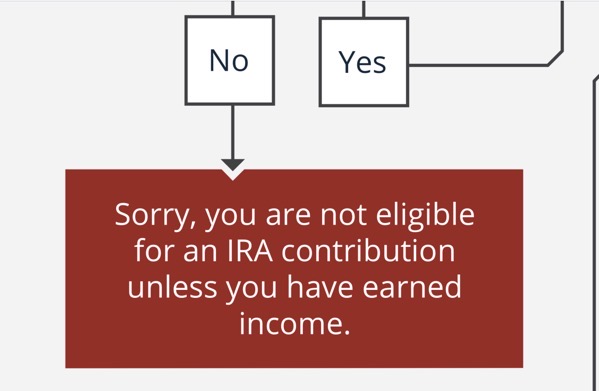

To help make the analysis easier, we have created the ”Can I Make A Deductible IRA Contribution” flowchart. It addresses common factors affecting eligibility rules for traditional IRAs, including:

-

Earned income

-

Coverage under an employer plan

-

Other (Roth) IRA contributions

-

Filing status-based MAGI thresholds

from Charles Schwab website:

Types of IRAs

Traditional IRA

-

Contributions may be tax deductible.

-

Withdrawals of pre-tax contributions and earnings are taxed as current income during retirement.

-

No income limitations.

-

Roth IRA

-

Contributions are not tax deductible.

-

Withdrawals are generally tax-free and penalty free after five years and after age 59½.

-

Income eligibility limitations.

Roth IRA

With a Roth IRA account, you won’t pay taxes as your money potentially grows, and you can make tax-free withdrawals during retirement.

What is a Roth IRA?

A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and earnings can grow tax-free, and you can withdraw them tax-free and penalty free after age 59½ and once the account has been open for five years.

Roth IRA vs. Traditional IRA

No matter what stage of life you’re in, it is never too soon to start planning for retirement, as even the small decisions you make today can have a big impact on your future. While you might already be invested in an employer-sponsored plan, an Individual Retirement Account (IRA) allows you to save for your retirement on the side, and also potentially save on taxes. There are different types of IRAs, too, with different rules and benefits. With a , you contribute after-tax dollars, your money grows tax-free, and you can generally make tax- and penalty-free withdrawals after age 59½. With a , you contribute pre- or after-tax dollars, your money grows tax-deferred, and withdrawals are taxed as current income after age 59½.

The following infographic will breakdown other main differences you need to know between a Roth IRA and Traditional IRA, highlighting their benefits to help you determine which option is right for your specific retirement goals.

Why consider a Roth IRA?

A Roth IRA can be a good savings option for those who expect to be in a higher tax bracket in the future, making tax-free withdrawals even more advantageous. However, there are income limitations to opening a Roth IRA, so not everyone will be eligible for this type of retirement account.

What benefits do Roth IRAs provide for your retirement?

-

No contribution age restrictions

You can contribute at any age as long as you have a qualifying earned income.

-

Earnings grow tax-free

Contributions and potential investment gains accumulate tax-free.

-

No income taxes for inherited Roth IRAs

If you pass your Roth IRA onto your heirs, their withdrawals will also be income tax-free.

-

Qualified tax-free withdrawals

Withdrawals can be taken out tax-free and penalty free, provided you’re age 59½ or older and you have met the minimum account holding period (currently five years).