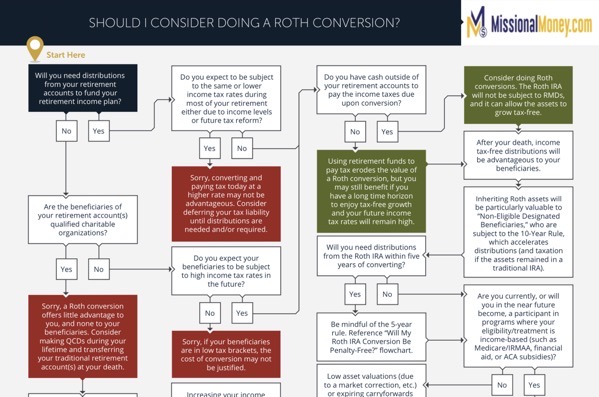

Should I Consider Doing A Roth Conversion? There are a lot of important considerations to weigh before doing a Roth conversion. As a result of the current market condition and changes due to the SECURE Act, Roth conversions are becoming an important strategy that is worth discussing. This flowchart addresses some of the major decision points to help you be guided through the conversation.

This flowchart covers:

-

Changes in marginal tax rates for you (or your heirs)

-

Ability to pay the associated tax with cash outside the retirement account

-

Five-year rule implications

-

Download:

Does it ever make sense to pay taxes on retirement savings sooner rather than later? When it comes to a Roth Individual Retirement Account (Roth IRA), the answer could be yes. A Roth IRA is funded with after-tax dollars, and qualified withdrawals are entirely tax-free.1 Additionally, Roth IRAs aren’t subject to required minimum distributions (RMDs), which gives you greater control over your taxable income in retirement.

Who can contribute to a Roth IRA?

You can’t contribute to a Roth IRA if your modified adjusted gross income (MAGI) equals or exceeds certain limits ($140,000 for single filers and $208,000 for married couples filing jointly in 2021). But there’s a workaround: A Roth IRA conversion allows you, regardless of income level, to convert all or part of your existing traditional IRA funds to a Roth IRA.

Who should consider converting to a Roth IRA?

You must pay income taxes on any converted funds in the year of the conversion, but there are several scenarios in which that might be to your advantage:

-

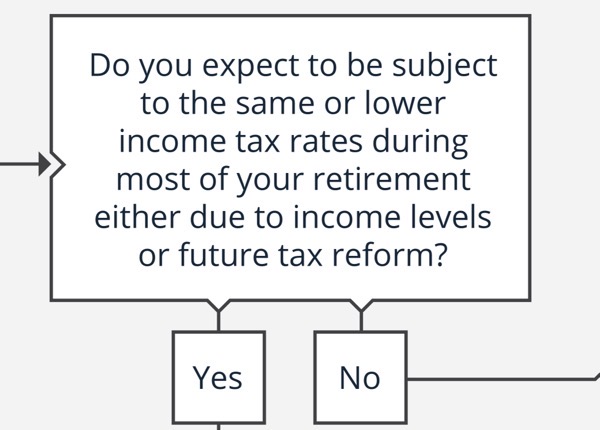

You believe your tax bracket will be higher in retirement. In this scenario, paying taxes at your current tax rate is preferable to paying a higher rate after you’ve stopped working. Paying higher taxes in retirement may sound farfetched, but it’s possible, especially if you haven’t yet hit your peak earning years or you’ve accumulated significant savings in your retirement accounts. It could make sense to convert all or a portion of funds in a traditional IRA to a Roth today and not in the future.

-

You want to maximize your estate for your heirs. If you don’t need to tap your IRA funds during your lifetime, converting from a traditional to a Roth IRA allows your savings to grow undiminished by RMDs, potentially leaving more for your heirs, who can also benefit from tax-free withdrawals during their lifetimes.

-

You don’t have much tax diversification of account types. That is, most of your assets are in tax-deferred accounts. By converting to a Roth IRA, you’ll have assets that won’t be taxed when withdrawn, potentially allowing you to better manage your tax brackets and enable more personalized tax planning during retirement.

-

You have irregular income streams and lower than usual income this year. For example, you might own a business that generated a net operating loss from non-passive income. This could be the perfect opportunity to convert some funds to a Roth IRA with a relatively low tax impact.

For some people, sticking with a traditional IRA or other tax-deferred accounts might be a better strategy. A Roth conversion might not be the best option in the following situations:

-

You’re nearing, or in retirement and you need your traditional IRA to cover your living expenses. In this situation, if you convert savings in an IRA to a Roth IRA but may need to spend that money soon, your assets may not have time to recoup from the taxes you would have to pay.

-

You’re currently receiving Social Security or Medicare benefits. If a Roth conversion were to increase your taxable income, then more of your Social Security benefits would be taxed and your Medicare costs could rise.

-

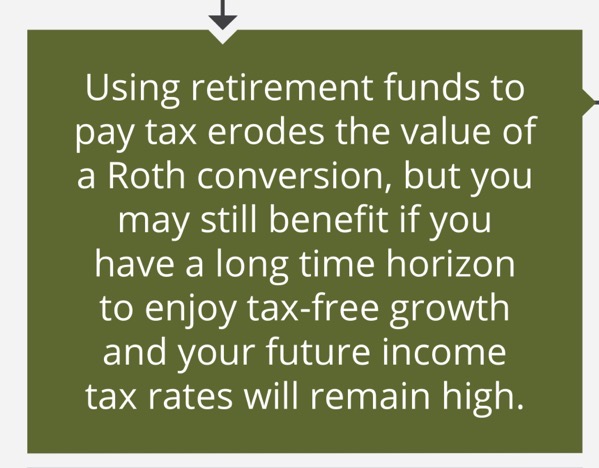

You don’t have money in your taxable account to pay the conversion tax.Preferably your taxable account has assets with a high basis or no gains that need to be taxed. If you have to pay tax due on the withdrawals to fund the conversion with savings from your IRA, it would take even longer to recoup the tax loss and may negate the benefits.

-

You plan on giving a substantial amount of your traditional IRA to charities. You could do this by utilizing a Qualified Charitable Distribution (QCD) to meet your RMD requirements. If you don’t plan on using your IRA assets yourself or passing them on to heirs, then a QCD could minimize or reduce the tax impact of RMDs. In this case, converting to a Roth IRA could be counterproductive, since you wouldn’t avoid taxes as you would with just a QCD.

How do you convert to a Roth IRA?

If you decide a Roth IRA conversion is right for you, you’ll need to keep three things in mind:

-

When to execute the conversion. If you have a significant balance in your traditional IRA, you may want to carry out multiple Roth IRA conversions over several years, which we call a systematic Roth conversion plan. If done properly, a multiyear approach could allow you to convert a large portion of your savings to a Roth IRA while limiting the tax impact. For example, you might convert just enough to keep additional distributions from being taxed at the next higher tax bracket. Early in retirement—when your earned income drops but before RMDs kick in—can be an especially good time to implement this strategy. One issue to be mindful of is making Roth conversions when you are close (within two years) to filing for Medicare and Social Security. A Roth conversion could increase your Medicare premiums and the taxes you pay on benefits.

-

How you’ll pay the resulting tax bill.

We recommend paying with cash from outside your IRA for a couple of reasons:

-

Any IRA money used to pay taxes won’t be accumulating gains tax-free for retirement, undermining the very purpose of a Roth IRA conversion.

-

If you sell appreciated assets to pay the conversion tax, capital-gains taxes could further undermine the benefits of a conversion. Plus, if you’re under 59½ and withdraw money from a tax-deferred account, you’ll incur a 10% federal penalty (state penalties may also apply).

-

-

You can’t undo a Roth conversion. Under the Tax Cuts and Jobs Act of 2017, you can no longer “recharacterize” or undo a Roth conversion. Once you convert, there’s no going back.

The decision to convert to a Roth IRA doesn’t have to be all or nothing. You may find dividing your savings between a Roth and a traditional IRA or a Roth IRA and a traditional 401(k) is the optimal solution for you. Overall, converting to a Roth IRA might give you greater flexibility in managing RMDs and potentially cut your tax bill in retirement, but be sure to consult a qualified tax advisor and financial planner before making the move, and work with a tax advisor each year if you choose to put into action a multi-year systematic Roth conversion plan.

1Qualified distributions are those that occur at least five years after the account is established. At least one of the following conditions must also be met: The account holder is 59½ or older at the time of withdrawal; the account holder is permanently disabled; distributed assets (up to $10,000) are used toward the purchase or rebuilding of a first home for the account holder or a qualified family member; or withdrawals are made by the account beneficiary after the account holder’s death.

Related topics

Important Disclosures

This information is not intended to be a substitute for specific individualized tax, legal or investment-planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner or investment manager.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers are obtained from what are considered reliable sources. However, their accuracy, completeness and reliability cannot be guaranteed.

Roth IRA conversions require a 5-year holding period before earnings can be withdrawn tax free and subsequent conversions will require their own 5-year holding period. In addition, earnings distributions prior to age 59 1/2 are subject to an early withdrawal penalty.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.