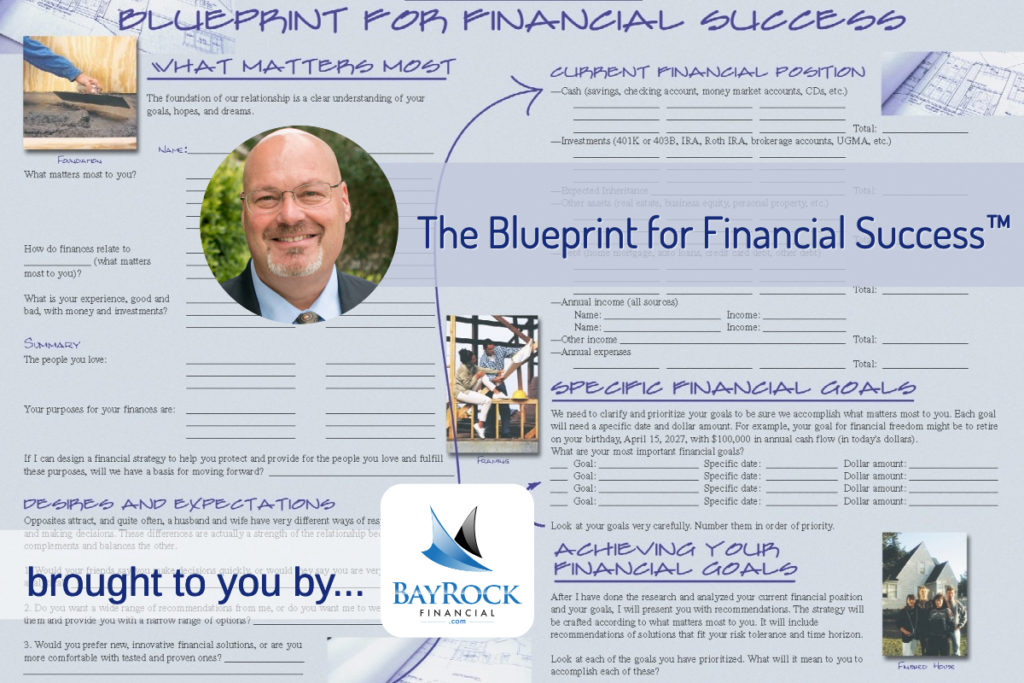

Blueprint for Financial Success ™

Helping special families (like yours) create simplicity and stability by building wealth, protecting assets, and staying focused on What Matters Most.

Our Product is Our Promise

Total Wealth Management Systems

Learn more about The BayRock Blueprint by visiting…

BayRockBlueprint.com

- The BayRock Blueprint for Financial Success utilizes the most current and secure technology to design and deliver holistic financial planning and investment management.

- The BayRock Blueprint is a subscription-based package starting at $100 per month.

- The Blueprint is a Total Wealth Management System designed for families.

The BayRock Blueprint for Financial Success was designed by a team of Financial Advisors and a Certified Financial Planner™ practitioner while working on Wall Street at Morgan Stanley.

BayRock Financial, LLC is a Houston-based Independent RIA with offices in the UH Technology Bridge.

Our mission is to help individual investors, families, and business owners manage the risk and opportunity of everyday life, recover from the unexpected, and realize their highest purpose.

The BayRock Blueprint for Financial Success involves much more than professional financial planning. Our family financial coaching and portfolio management services add meaningful value compared to the average investor experience.

How It Works

You Talk. We Listen.

- First, we get to know you, your goals, your vision, values, and purpose.

- We don’t use a one-size fits-all approach to financial planning.

- Our questions help us see your bigger financial picture.

- Then, we craft a customized plan (Blueprint) that’s truly unique to you and your family’s needs, wants, and wishes.

Did You Know

- BayRock advisors have no financial incentives to recommend any specific products.

- We are fiduciaries.

- Our goal is to help you make wise financial decisions for you and your family.

- We collaborate and coordinate with your Financial Advisory team to apply our best thinking to your case.

- BayRock uses innovative technology and our time-tested investment philosophy to create your comprehensive financial plan.

- Then, we share it with you, walk you through it step-by-step.

- We answer all your questions before asking you to commit to anything.

- When you’re ready, we put your plan into action.

That’s How BayRock Delivers

Smarter Strategies and Better Results

- Tax Mitigation Strategies

- Risk Management Strategies

- Estate Planning Strategies

- Investment Planning Strategies

- Charitable Giving Strategies

- Education Funding Strategies

- Retirement Income Strategies

- Social Security Maximization

- And much, much more.

Family Financial Education

- BayRock advisors help educate the whole family.

- We can advise on estate planning,

- Help you create a succession plan,

- Provide clear guidance on charitable giving to the causes you care about.

- BayRock combines low-cost funds with tax-smart strategies to maximize your tax savings.

- We help you keep more of your money.

Why Charles Schwab

Over 40 years ago, Schwab defied the financial services industry by building a company with no outside investors and they created the first index fund for individual investors.

- Schwab has 30 million investors and growing.

- Schwab has no outside owners, they only serve independent investors and the RIAs (like BayRock) who advise them.

- Every decision BayRock makes has you in mind and we’re proud to be aligned with Charles Schwab as our primary custodian.

Transparent Pricing

- BayRock fees are lower than the industry average.

- We’re happy to negotiate the best price for you.

- Our annual cost for Wealth Management includes Advisor Coordination.

- When BayRock manages a substantial amount of assets for you, the cost of the services gets even lower.

- Family members have no minimum and we offer your family a discount based on the amount of assets we manage for you.

- Our yearly fee is broken into 4 payments, billed quarterly.

- We offer Monthly subscription-based planning starting at $100 per month.