Deductible IRA Contribution

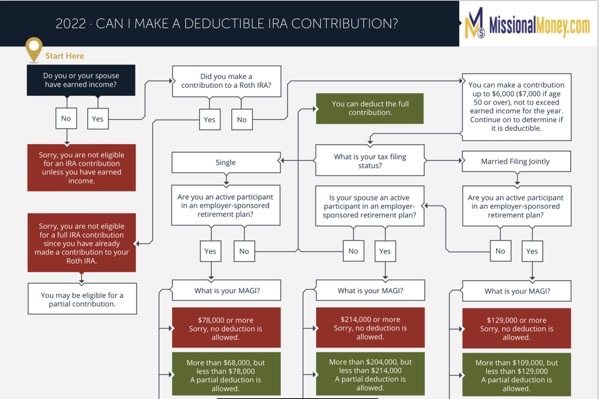

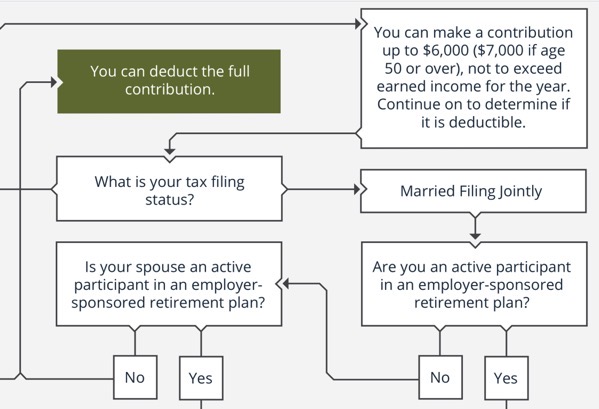

Can I Make A Deductible IRA Contribution? A traditional IRA is a great option when you’re looking to save for retirement in a tax-deferred account. However, there are many factors to consider when determining whether you are eligible to make contributions, and whether such contributions will be deductible or not.

To help make the analysis easier, we have created the ”Can I Make A Deductible IRA Contribution” flowchart. It addresses common factors affecting eligibility rules for traditional IRAs, including:

Earned income

Coverage under an employer plan

Other (Roth) IRA contributions

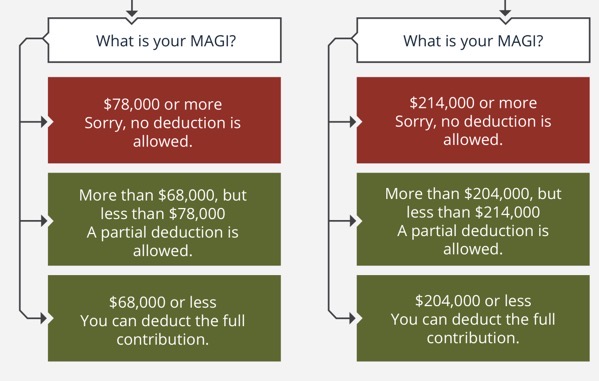

Filing status-based MAGI thresholds

Download: Making A Deductible IRA Contribution

Deductible IRA Contribution Overview

Deductible IRA Contribution Start Here

Deductible IRA Contribution What is Your MAGI?

Deductible IRA Contribution What is Your Filing Status?

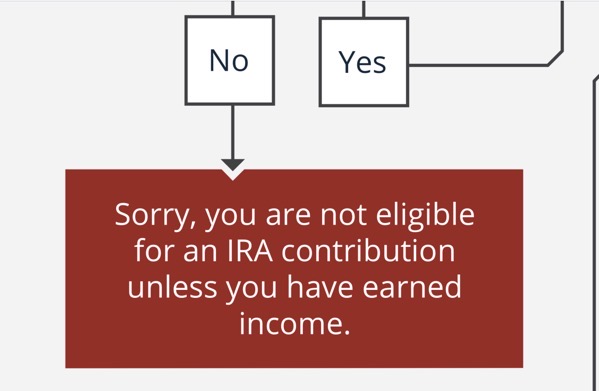

Deductible IRA Contribution Earned Income Required

Roth IRA vs Traditional IRA from Charles Schwab website:

Types of IRAs

Traditional IRAs, Roth IRAs, and Rollover IRAs are the three most commonly chosen individual retirement options. Variations of common IRA types include Inherited IRAs and Custodial IRAs. Each IRA has its own characteristics to evaluate when setting your retirement savings goals.

Traditional IRA

Contributions may be tax deductible. See Traditional IRA limits.

Withdrawals of pre-tax contributions and earnings are taxed as current income during retirement.

No income limitations.

Roth IRA

Contributions are not tax deductible. See Roth IRA contribution limits.

Withdrawals are generally tax-free and penalty free after five years and after age 59½.

Income eligibility limitations.

Roth IRA

With a Roth IRA account, you won’t pay taxes as your money potentially grows, and you can make tax-free withdrawals during retirement.

What is a Roth IRA?

A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and earnings can grow tax-free, and you can withdraw them tax-free and penalty free after age 59½ and once the account has been open for five years.

Roth IRA vs. Traditional IRA

No matter what stage of life you’re in, it is never too soon to start planning for retirement, as even the small decisions you make today can have a big impact on your future. While you might already be invested in an employer-sponsored plan, an Individual Retirement Account (IRA) allows you to save for your retirement on the side, and also potentially save on taxes. There are different types of IRAs, too, with different rules and benefits. With a Roth IRA, you contribute after-tax dollars, your money grows tax-free, and you can generally make tax- and penalty-free withdrawals after age 59½. With a Traditional IRA, you contribute pre- or after-tax dollars, your money grows tax-deferred, and withdrawals are taxed as current income after age 59½.

The following infographic will breakdown other main differences you need to know between a Roth IRA and Traditional IRA, highlighting their benefits to help you determine which option is right for your specific retirement goals.

Why consider a Roth IRA?

A Roth IRA can be a good savings option for those who expect to be in a higher tax bracket in the future, making tax-free withdrawals even more advantageous. However, there are income limitations to opening a Roth IRA, so not everyone will be eligible for this type of retirement account.

What benefits do Roth IRAs provide for your retirement?

No contribution age restrictions

You can contribute at any age as long as you have a qualifying earned income.

Earnings grow tax-free

Contributions and potential investment gains accumulate tax-free.

No income taxes for inherited Roth IRAs

If you pass your Roth IRA onto your heirs, their withdrawals will also be income tax-free.

Qualified tax-free withdrawals

Withdrawals can be taken out tax-free and penalty free, provided you’re age 59½ or older and you have met the minimum account holding period (currently five years).