Can I Contribute To My Roth IRA

Can I Contribute To My Roth IRA? A Roth IRA is a great option for you who is looking to save after-tax dollars, offering the opportunity for tax-free growth and relaxed distribution rules. Unfortunately, eligibility to contribute to a Roth IRA is subject to restrictions, which can cause confusion.

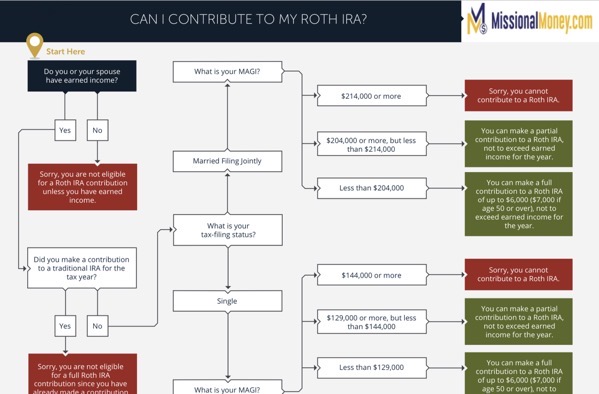

To help make the analysis easier, we have created the “Can I Contribute To My Roth IRA” flowchart. It addresses the key eligibility considerations, including:

Earned income

Other (traditional) IRA contributions

Filing status-based MAGI thresholds

Instant Download: Contributing To My Roth IRA

A Roth IRA is an IRA that, except as explained below, is subject to the rules that apply to a traditional IRA.

- You cannot deduct contributions to a Roth IRA.

- If you satisfy the requirements, qualified distributions are tax-free.

- You can make contributions to your Roth IRA after you reach age 70 ½.

- You can leave amounts in your Roth IRA as long as you live.

- The account or annuity must be designated as a Roth IRA when it is set up.

The same combined contribution limit applies to all of your Roth and traditional IRAs.

Limits on Roth IRA contributions based on modified AGI

Your Roth IRA contribution might be limited based on your filing status and income.

- 2023 – Amount of Roth IRA Contributions You Can Make for 2023

- 2022 – Amount of Roth IRA Contributions You Can Make for 2022

Additional resources

- Details about Roth IRAs are contained in Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) and Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs) and include:

- Setting up your Roth IRA;

- Contributions to your Roth IRA; and

- Distributions (withdrawals) from your Roth IRA.

- Differences Between Roth IRAs and Designated Roth Accounts

- Individual Retirement Arrangements (IRAs)

Can I Contribute To My Roth IRA Overview

Can I Contribute To My Roth IRA – Start Here: Do you or your spouse have earned income?

Can I Contribute To My Roth IRA – Did you make a contribution to a traditional IRA for the tax year?

Can I Contribute To My Roth IRA – what is your tax-filing status?

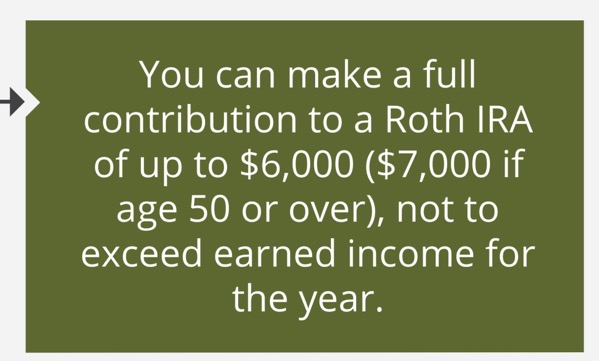

Can I Contribute To My Roth IRA If YES, how much?

For More information, check out IRS.gov

For 2023, the total contributions you make each year to all of your traditional IRAs and Roth IRAs can’t be more than:

- $6,500 ($7,500 if you’re age 50 or older), or

- If less, your taxable compensation for the year

For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs can’t be more than:

- $6,000 ($7,000 if you’re age 50 or older), or

- If less, your taxable compensation for the year

The IRA contribution limit does not apply to:

- Rollover contributions

- Qualified reservist repayments

Deducting your IRA contribution

Your traditional IRA contributions may be tax-deductible. The deduction may be limited if you or your spouse is covered by a retirement plan at work and your income exceeds certain levels.

Roth IRA contribution limit

In addition to the general contribution limit that applies to both Roth and traditional IRAs, your Roth IRA contribution may be limited based on your filing status and income.

- 2023 – Amount of Roth IRA Contributions You Can Make for 2023

- 2022 – Amount of Roth IRA Contributions You Can Make for 2022

IRA contributions after age 70½

For 2020 and later, there is no age limit on making regular contributions to traditional or Roth IRAs.

For 2019, if you’re 70 ½ or older, you can’t make a regular contribution to a traditional IRA. However, you can still contribute to a Roth IRA and make rollover contributions to a Roth or traditional IRA regardless of your age.

Spousal IRAs

If you file a joint return, you may be able to contribute to an IRA even if you didn’t have taxable compensation as long as your spouse did. Each spouse can make a contribution up to the current limit; however, the total of your combined contributions can’t be more than the taxable compensation reported on your joint return. See the Kay Bailey Hutchison Spousal IRA Limit in Publication 590-A.

If neither spouse participated in a retirement plan at work, all of your contributions will be deductible.

Can I contribute to an IRA if I participate in a retirement plan at work?

You can contribute to a traditional or Roth IRA even if you participate in another retirement plan through your employer or business. However, you may not be able to deduct all of your traditional IRA contributions if you or your spouse participates in another retirement plan at work. Roth IRA contributions might be limited if your income exceeds a certain level.

Examples

- Danny, an unmarried college student earned $3,500 in 2020. Danny can contribute $3,500, the amount of his compensation, to his IRA for 2020. Danny’s grandmother can make the contribution on his behalf.

- John, age 42, has a traditional IRA and a Roth IRA. He can contribute a total of $6,000 to either one or both for 2020.

- Sarah, age 50, is married with no taxable compensation for 2020. She and her spouse, age 48, reported taxable compensation of $60,000 on their 2020 joint return. Sarah may contribute $7,000 to her IRA for 2020 ($6,000 plus an additional $1,000 contribution for age 50 and over). Her spouse may also contribute $6,000 to an IRA for 2020.

Tax on excess IRA contributions

An excess IRA contribution occurs if you:

- Contribute more than the contribution limit.

- Make a regular IRA contribution for 2019, or earlier, to a traditional IRA at age 70½ or older.

- Make an improper rollover contribution to an IRA.

Excess contributions are taxed at 6% per year for each year the excess amounts remain in the IRA. The tax can’t be more than 6% of the combined value of all your IRAs as of the end of the tax year.

To avoid the 6% tax on excess contributions, you must withdraw:

- the excess contributions from your IRA by the due date of your individual income tax return (including extensions); and

- any income earned on the excess contribution.