What do you believe about Credit and Debt?

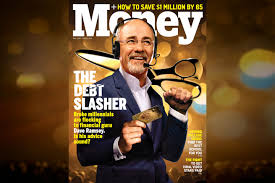

Over the years, teaching Personal Finance at the Bauer College of Business at University of Houston, I’ve had the opportunity to work with Dave Ramsey and his daughter, Rachel Cruze. I’ve watched many hours of videos created by their team with one purpose: Eliminate Credit Card Debt

I’ll never forget the first time I visited Dave’s offices just outside of Nashville, TN. If you’ve never had the opportunity of taking the tour, you don’t want to miss it. The most remarkable thing I saw was thousands and thousands of hand-written notes — on every wall of every room on every floor in every building. The notes were people who stopped into the Ramsey offices to write their “Debt Free Declaration” in their own hand-writing ON THE WALL.

It’s a beautiful thing to see.

From a recent student post

American culture has over the years learned to embrace and promote debt as a societal norm. Houses and cars are rarely ever paid for in cash and are most of the time accompanied by years-long debts that end up costing the buyer more than the original worth. Americans accept and embrace these facts as inevitable parts of life and purchase more and more things with borrowed money.

Credit card companies are expert marketers who target the young and lure them into paying to give up their own economic freedoms. Children, teenagers and college students are prime targets for their brutal marketing tactics. As a student, I regularly receive mail, electronic and physical, as well as phone calls from banks and credit card companies trying to sell me debt. I am asked to borrow student loans every semester, and I have almost mindlessly complied because “I can’t afford tuition right now.” Rather than working, investing and waiting until I can afford, I have borrowed and thus given up my economic freedom. It is time to learn to avoid these mistakes in the future and efficiently work my way out of the situation.

Dave Ramsey wants to convince Americans to go against the grain and the massive forces of marketing that promote debt and credit in American culture.

Debt has become such a common thing in American society that you are expected to have credit cards and make loans to pay for school, housing and jobs.

But debt is costly and will tend to restrain rather than free.

Credit card companies make gross revenue of $150 billion per year, and the nation itself is expected to have a debt of over $20 trillion by year 2020.

That was true before Covid-19 and the massive reaction of the Fed. Have you seen the national debt clock lately? It’s already over $25 Trillion — with a T.

Dave Ramsey highlights some of the history of credit, from the 1910s when companies like Sears and JC Penney condemned going in debt to the mid-1980s when Sears created Discover Card.

Repeated promotions and myths about credits have led it to almost carry a prestigious connotation in our culture, which is why turning away from it may be difficult for many Americans.

Money is the #1 Reason for Divorce in America

Do you believe that statistic?

Dave Ramsey recently shared 15 “myths” about credit

- “If I loan money to a friend or relative, I am helping them.” This is a myth because what will actually end up happening is that the relationship will become strained or destroyed and turned into a master-servant relationship.

- “By cosigning a loan I’m helping a friend or relative.” This is a myth because the bank requires cosigning only when a borrower is unlikely to repay the debt, thus the debt ends up on your name and you will likely have to pay the loan and have your credit damaged. This will likely be harmful to the relationship. You should only give money if you do not expect it back.

- “Cash Advance, payday lending, rent-to-own, etc. are necessary services that help lower income people get ahead.” The truth is, these services are rip-offs that benefit only lenders by overcharging interest. There have even been laws passed in order to prevent these types of services from overcharging military personnel who may fall victim for these scams.

- “The lottery and other forms of gambling will make you rich.” The truth is that the poor and uneducated make up the majority of players of the lottery. The poor gamble more money at the lottery at a higher rate than wealthier peoples. They are basically throwing money out the window for the miniscule chance that they will receive a large return. This money could have been invested for a guaranteed return instead.

More Credit Myths Related to Cars

- “Car payments are a way of life and you always have a car payment.” The truth is that the average, self-made millionaire avoids expensive car payments by driving reliable, used cars rather than buying fancy new vehicles. After 4 years, an average new car will have lost 70% of its value and you’re paying payments for more than the car is worth.

- “Leasing your car is what sophisticated financial people do.” This is a big lie as leasing is the most expensive way to finance and operate a vehicle. Car retailers earn an average of $82 selling a new car, $775 accepting periodic payments, and $1300 leasing it

- “You can get a good deal on a new car.” New cars are generally the largest purchase consumers make that decreases in value.

- Dave states that rich people ask, “how much?” while the poor ask, “how much down and how much a month.”

More Credit Myths About Mortgages

- “I’ll take out a 30-year mortgage and pay extra.” The truth is that when you give yourself the option to pay more or less, life can happen and something else will seem more important than paying extra on the loan. You should never take out more than a 15-year mortgage or more than 1/4th of take-home pay in payments. Stick to a fixed interest rate.

- “It’s wise to take out an ARM or balloon mortgage if you know you’ll be moving.” Fixed rate mortgages give you the best managerial power over your debt and make sure no unexpected increases in payments sneak up on you.

- “You need a credit card to rent a car or make a purchase online or over the phone.” This is false, because you can do all these things with a debit card using your own money.

- “I pay my credit card off every month with no annual payments or fees.” Studies show using a card causes you to spend more than you would using cash, so there is an indirect increase in cost.

- “I’ll make sure my teenager gets a credit card so that they can learn to be responsible with money.” Teens and kids are the #1 target for credit card companies today because they are often unemployed and financially irresponsible, giving them access to a credit card early in life can cause financial harm and debt later on.

- “Home equity loan is good for consolidation and is a substitute for an emergency fund.” This is a lie because an emergency fund is built using your own money unlike a loan which will put you in debt.

- “Debt consolidation saves interest and you get a smaller payment.” The truth is that debt consolidation saves little or no interest because you throw low- or no-interest loans into a mix with high-interest loans.

- “Debt is a tool that should be used to create prosperity.” The truth is that debt makes the borrower slave to the lender.

One of my favorite Dave Ramseyisms is what he calls “Gazelle Intensity”. Basically, if you’re in debt — you should work fast and furious to get out of debt.